More than half of all M&A transactions and post-merger integrations end up destroying value.

Whether a result of poor strategic fit, cultural conflicts, insufficient due diligence or thwarted execution, the remarkable truth here is that these statistics are from normal healthy economic conditions.

Today, the conditions for business are not normal.

World GDP is shrinking and bedrock trade conventions are buckling and the strains of global reconfiguration under intense inflationary pressures.

Historically, such economic climate portends fewer M&As. So, divestitures, JVCs and Spinoffs by contrast should see a resurgence as investors leverage synergies to offset cross-functional and cross-jurisdictional innovation risk.

Our teams compliment the leading financial and legal advisors heading mergers and acquisitions in post-merger integration. Our focus is on the enterprise data, IT and operational aspects of the businesses.

We provide the same strategic decision support in executing divestitures, joint ventures and spinoffs.

Our goal is to help you prevent alignment debt that could undermine integration and separation activities later, killing deadlines and inflating costs and reputation risk unexpectedly.

Case Study: Post-merger Lead-to-cash (LTC) Transformation

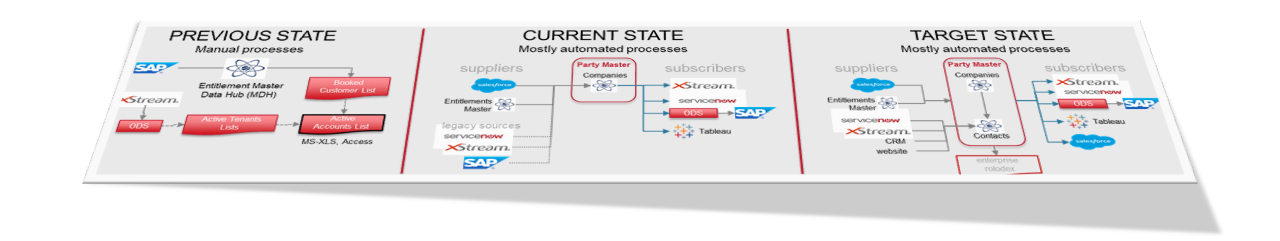

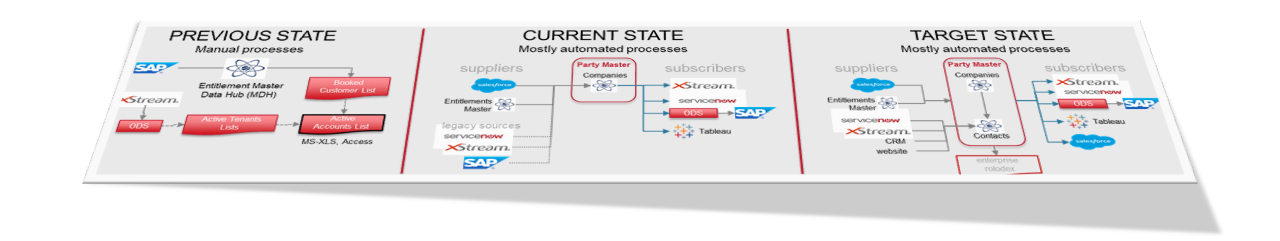

We coordinated the efforts of sales, finance, engineering, operations and support teams across the enterprise to rationalize legacy systems from several companies with the acquirer’s world-class processes built on SAP.

Facilitated the replacement of legacy tools and the automation of processes between systems and teams focused squarely on revenue collection. We delivered three master data hubs (parties, SKUs and entitlements) that simplified data sharing between teams - from sales, through ordering, fulfillment, utilization, user support and billing.